Mary Meeker on retail, mobile and social in 2016

Each year, the release of the Mary Meeker internet trends report provides retailers with a detailed review of online trends. Although some of the data is from the US, the trends discussed can certainly also be seen in the Australian market.

The report from Mary Meeker covers no less than 213 pages, with a strong focus on mobile and retail, from which I’ve put together an overview of the key takeaways for retailers. All slides from the 2016 Mary Meeker internet trends report can viewed here.

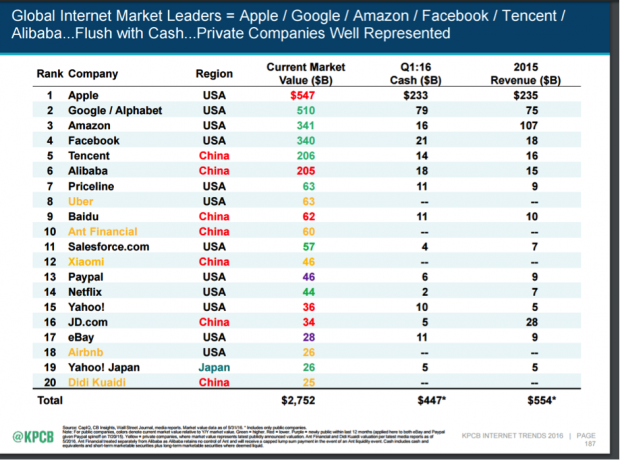

ABOVE: An overview of the top 20 leaders and the incredible market value they hold.

Generational change: One of the emerging retailers identified is Casper, which sells mattresses online; obsessively engineered mattresses at a very fair price. You can sleep on a Casper for 100 days, and they provide free delivery and painless returns. They are servicing a quality-driven, price-conscious Gen Z customer segment which, according to Fitch, “expect retailers to be awake at 3am”. Their success can be validated by 320,000 Facebook likes and very positive consumer sentiment.

Internet as distribution channel: E-commerce continues to grow; some stores, such as John Lewis, now see 40 per cent of sales coming from online. But the biggest growth opportunity lies with m-commerce. According to Simon Nankerverais from Neiman Marcus, when online sales are over 20 per cent there is a linear correction with sales and general administration expense (SGNA) and if you do not correct this, it will impact you. Most physical retailers predict that online sales will hit a ceiling, expected to be at 40 per cent of total sales, and are currently facing this adjustment.

Products become brands: There is a new norm emerging in the retail industry of brands becoming retailers. For example; Warby Parker (valued at 1.2 billion in its last round of funding) has moved from brand to retail. In addition to this, retailers are becoming products themselves. For example thrive, an online natural and organic retailer.

Digital to physical: Digital to physical is a trend we have seen grow rapidly across the last year, and there is no stopping this one. The digital retailers pose much more of a threat in the physical world due to their customer-centric digital platforms, and their data driven approach to retailing. Stitch Fix is an example of a retailer taking a data-driven approach; the $250 million start-up is redefining personalisation. They are applying a Netflix and Spotify content discovery process, where 100 per cent of sales onsite come from recommendations in collaboration with their stylist.

Internet as a growth accelerator: It took Nike 14 years, Lululemon nine years and Under Armour eight years to reach $100 million dollars. Data just goes to prove that the internet is not only contributing to the growth of physical retailers, but actually accelerating it.

User-shared video growth: What we do know, and what is being seen on all of the channels I am working with clients on, is that video is evolving and continues to grow rapidly. And that means that imagery is absolutely key for millennials. According to Social Science Research, 65 per cent of us are visual learners, so if we want consumers to learn about our brands/products, visuals is key. Couple that with an eight-second attention span, and a multiple of screens (times five for Gen Z), and those visuals have to have a strong “wow” factor to achieve cut-through with audience. It’s the image-based platforms that are driving real sales.

Conversational apps: Conversational apps are the perfect example of how mobile is to be used. Mobile was originally developed for this purpose, then we shoved the internet into it and in the process we lost the art of communication. We are now seeing a growing trend back into conversational apps and integration with existing messaging applications. Messaging applications by the way, is where we spend more of our time. This evolution is feeding a “let me shop when and where I want” demand, which isn’t just physical and digital but also on a micro-level. Within messaging applications, on my TV screen, on the dashboard in our car – and all the places that technology touches our lives.

Connecting with millennials: The way we converse has evolved, and we now rely on text as much as voice. The new generations do not want to talk directly with brands. In saying that, they want to connect more than any other generation has, just through different format and therefore are purposeful in the their communication with brands and retailers.

Investment in apps: When you look at the average number of apps that account for 80 per cent of our time (only three), and then you look at the investment from brands in apps over the past few years, the cost per user becomes astronomical. Building an app can range in cost anywhere from $150,000 to $1,000,000. Until we reach a point where apps provide real value to the consumer, over and above a retailer’s website or mobile site, we will continue to see a high cost per acquisition, a low user retention rate and high negative sentiment – coupled with lots of uncomfortable questions at a board level!

Messaging apps: Messaging apps are becoming our second screen, and retailers need to look at how to integrate and add value within these platforms, while ensuring not to interrupt the flow of communication. The “secret sauce”, according to Mary Meeker, is remembering context, time, identity and preferences.

All about voice: Voice is the next big trend, and as we see more advances in speech technology we will see a significant shift to voice activated technologies such as Amazon Echos Alexa. Although, I do have a strong belief that social etiquette, for some, will prevail, rendering these technologies to be used predominantly in personal spaces such as the home or the car. Voice accuracy is now equivalent to the human level in low noise environments.

Internet leaders: The current generation of internet retail leaders is growing faster than the former generation of leaders. Uber is growing faster than eBay, China’s JD.com is growing faster than Amazon.

View all slides from the 2016 Mary Meeker internet trends report for further information on the above points.

Kelly Slessor is a digital and mobile marketing strategist, and the founder and director of BanterMob Mobile Marketing Group. She can be contacted at kelly@bantermob.com.au.

Comment Manually

You must be logged in to post a comment.

No comments