Emerging players disrupt Chinese e-commerce giants

Established e-commerce giants in China face increased competition from emerging players in the market, according to a new ranking of the top 10 e-commerce retailers in the country.

eMarketer compiled the ranking based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies.

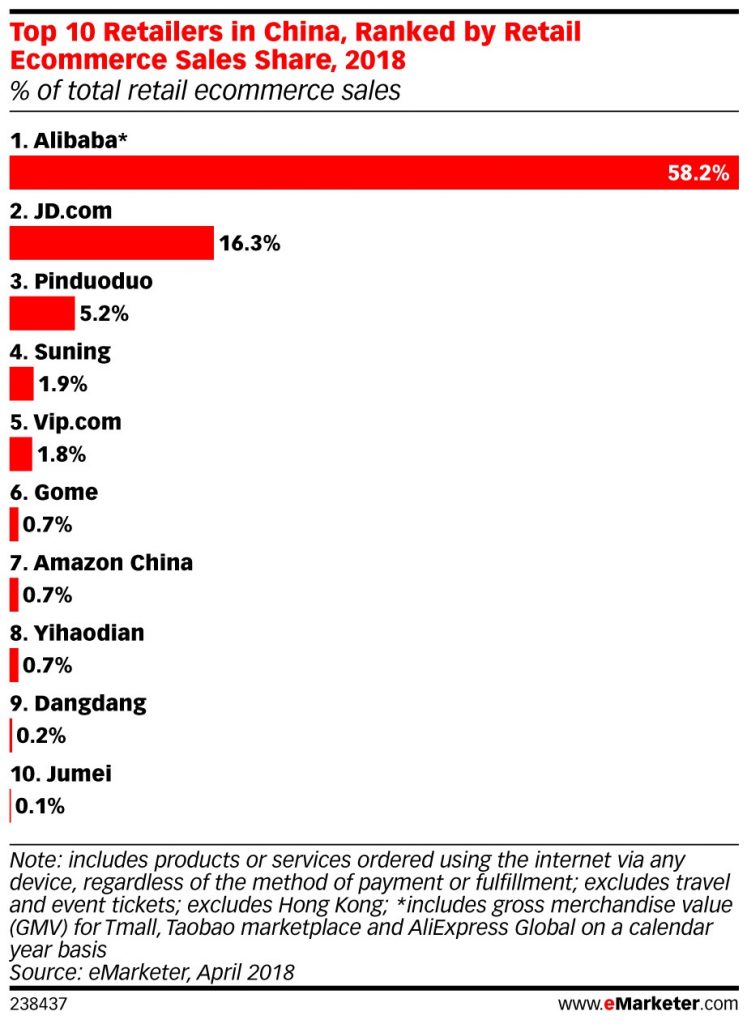

Combined, the retailers on the list are expected to account for more than 85 per cent of all retail e-commerce sales in China this year.

And while Alibaba and JD.com ranked first and second as expected – Alibaba with a 58.2 per cent share of all retail e-commerce sales, and JD.com with a 16.3 per cent share – smaller, more specialist players have become increasingly popular with consumers and credible competitors to the long-standing leaders in online retail.

“China’s smaller cities such as Tier 3, Tier 4 and lower are less urbanised than Tiers 1 and 2, but they are growing rapidly in e-commerce participation as digital buyers in those cities begin to seek out the benefits of more affordable yet genuine products online,” said Monica Peart, eMarketer’s senior director of forecasting.

“Smaller e-commerce players such as relative newcomer Pinduoduo have benefitted from this trend as buyers in lower-tier cities have been less tolerant of the higher prices found on large players such as Alibaba and JD.com, but they are quick to seize upon the relative deals found on Pinduoduo’s platform,” she said.

Some of the growing e-commerce players in China this year include:

Pinduoduo

A Groupon-style retailer that mixes in social buying, Pinduoduo (PDD) is expected to take home 5.2 per cent of all retail e-commerce sales this year. That’s up from a 0.1 per cent slice of the market when it launched in 2015, and third behind Alibaba and JD.com.

Started by a former Google engineer, PDD allows consumers to buy direct from wholesalers and factories at competitive prices. A key factor in PDD’s success to date is that it has targeted Tier 3 and Tier 4 cites in China, thus attracting new price-conscious e-commerce customers. In addition, PDD has made it relatively easy for sellers to enter the marketplace.

Gome

An online and offline multi-channel retailer that specialises in home goods, Gome is expected to take a 0.7 per cent share of all retail e-commerce sales in China this year. The company, which employs social sharing as part of its marketing strategy, has also begun to use its online data to support its offline offerings.

Suning

Suning, primarily an electronics retailer, has been exploring multi-channel integration over the past few years. This approach has proved profitable so far, and the company is expected to account for nearly 2 per cent of retail e-commerce sales in China this year.

Vipshop

An online discount retailer focused largely on fashion that offers high-quality and popular branded products, Vipshop was ounded in 2008. The company focuses on flash sales and has partnered with well-known players such as Tencent (owners of WeChat) and JD.com. The company has built a sizable base of loyal customers and is expected to take a 1.8 per cent share of the retail e-commerce sales market in China this year.

Here is the full ranking of the top 10 e-commerce retailers in the country, according to eMarketer.

Comment Manually

You must be logged in to post a comment.

No comments