Catch of the Day rebrands, launches online marketplace

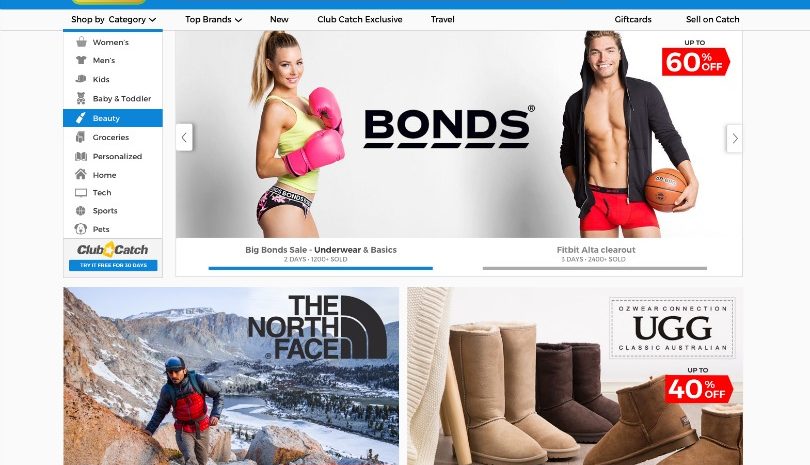

Catch of the Day, has launched an online marketplace and rebranded to Catch, as it looks to become a one-stop shop for online shoppers.

The aim is to have 300 sellers signed up to the marketplace by the end of the year, with Lorna Jane, Speedo, The North Face and ASUS already on board, according to a statement from Catch Group.

Gabby Leibovich, joint owner of Catch Group along with brother Hezi Leibovich, said the shift in strategy will help Catch reach a broader audience and capture higher value customers.

“We currently sell about 30,000 products at any given time, but that’s just a small drop in the ocean. If customers can’t find everything they want on Catch, they go somewhere else,” Gabby told Internet Retailing.

“By allowing a selected bunch of retailers to join the marketplace, we’re hoping buyers will be able to find more products than they’re used to and we’ll be able to complete more transactions on our site,” he said.

The marketplace will cover existing categories, including technology, beauty, fashion and wine, as well as new categories, such as books, lighting, homewares, furniture, outdoor equipment and white goods.

Gabby said the goal is to have over two million products on the marketplace by year’s end, with a focus on products that Catch currently has trouble sourcing or shipping. But that doesn’t mean letting “every Tom, Dick and Harry list their product” on the marketplace.

Unlike Ebay and Amazon, Catch won’t offer the same product from multiple sellers.

“Rather than inviting hundreds of sellers to sell a chair or an iPhone case, we’ll only invite one or two of them. And we’ll invite the ones that have a great price. We’re discounters, that’s why people come to us,” he said.

Gabby Leibovich, Catch Group owner

The marketplace will operate a drop-ship model, with retailers listing their own products, shipping products and communicating directly with buyers.

Meanwhile, Catch will continue to offer products it sources itself on the marketplace and ship them from its 26,000sqm Melbourne warehouse.

According to Gabby, this combination ensures Catch’s offering will be competitive when Amazon launches Marketplace in Australia.

“What really differentiates us from Amazon is we’re better buyers. We have 20 world-class buyers buying end of line and clearance from around the world. It’s what we do,” he said.

Catch has seen more than 10 per cent growth in top line sales and an increase of more than 30 per cent in gross profit in the past six months, which it attributes to better merchandising, promotions and smart customer acquisition strategies.

The company is on track to turn over more than $500 million in the next 12 months.

Gabby also cited Catch’s ability to offer exclusive brands like Pumpkin Patch, which the company acquired in March, and its travel offering as significant differentiators.

Brand banking

It’s a solid strategy, according to Queensland University of Technology associate professor Gary Mortimer.

“This is what I refer to as brand banking – buying brands and taking them out of the market, so you have exclusive licence to sell those brands,” Mortimer told Internet Retailing.

“A good example of this is Kogan buying Dick Smith and Myer signing exclusive agreements with fashion brands.”

And while Mortimer said Catch will need to dramatically increase the number of exclusive brands it offers to benefit from brand banking, he suggested the 11-year-old e-commerce company has a leg-up on Amazon when it comes to customer perception in Australia.

“The reason Amazon is the one-stop shop in the US is that it started operating there in 1995, when internet shopping was in its infancy. It conditioned shoppers very quickly to think of Amazon first,” Mortimer said.

“Australians already have relationships with incumbent retailers here. They already have their details logged in with Catch, and as it builds a marketplace, it already has a captured audience. Amazon will have to start from scratch [here].

“[Amazon] will have to have a big carrot to get customers to move. I think that’s where Catch has an advantage.”

But in other areas, Amazon is unquestionably miles ahead of the competition.

A/B testing

For instance, Catch only recently started offering personalised recommendations to customers and using A/B testing to optimise its website. It hired Manik Godhwani as head of product management in January to lead these efforts.

The former Snapdeal employee told Internet Retailing that Catch customers can expect to see more modern web design and features, as the front-end of the website continues to evolve over the next month.

“We’re working to make the website more personalised, with products shown based on your gender, location, past purchases and category affinity,” he said.

The website will soon also personalise its banners, so customers who don’t have kids won’t see a banner for the half-yearly toy sale. Godhwani expects these and other improvements to increase the overall conversion rate by 20 per cent.

“Just launching the category menu [into the website navigation] delivered a seven per cent increase in conversions,” he said.

While it isn’t unusual for a deals-based website to have so little focus on user experience, according to Godhwani, it leaves Catch with a lot catching up to do.

“Amazon has been doing this for years, we’ve just been doing it for a few weeks. It will take us time to catch up,” he said.

Gabby said that’s to be expected.

“If in a couple years we’re the second most successful player, I’ll be very happy.”

Nati Harpaz, CEO of Catch Group, is the chairman of Octomedia, Internet Retailing’s parent company.

Comment Manually

You must be logged in to post a comment.

No comments