MyDeal looks to grow after pivot to furniture, homewares

Online marketplace MyDeal expects to double the number of items it offers to more than a million, after completing an integration with US-based e-commerce company, ChannelAdvisor, that it says will speed up the onboarding of new sellers.

“This is a significant milestone in the business that signifies 12 to 18 months’ worth of work to get the technology right on our marketplace platform,” John Barkle, MyDeal’s head of marketing, said.

Listing products on a marketplace can be a time-consuming and labour-intensive process, depending on the marketplace’s information requirements, the number of products the seller wants to offer and the availability of software to automate the process.

Barkle acknowledged that, in the past, MyDeal’s bespoke technology may have presented a barrier to sellers wanting to join the platform, but he believes this problem has now been solved.

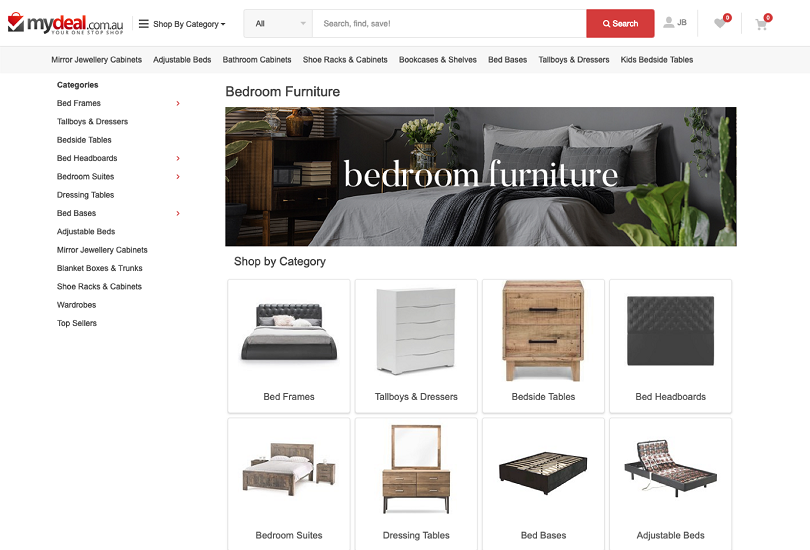

At the same time, MyDeal has shifted away from offering a wide range of products and categories to focusing on furniture and homewares.

The decision was reportedly based on internal data showing eight in 10 customers associate MyDeal with items for the home. It reverses the company’s previous growth strategy of expanding into new verticals, such as fashion and travel and diversifying through fintech solutions.

Since MyDeal was founded by Sean Senvirtne in 2012, the marketplace sector has become more crowded. Catch, Myer and most recently Kogan.com are now competing with the likes of eBay and Amazon through “department store” marketplaces. But becoming a niche marketplace in the furniture and homewares space is no guarantee of success either.

The move puts MyDeal up against larger and more established players, such as listed online furniture retailer Temple & Webster, which recently reported $49.3 million in revenue in the six months to December 31, a 40 per cent increase on the previous year. Barkle declined to share any earnings figures for MyDeal, which is a private company, but said the retailer recently became profitable.

“We run a very low-cost model, meaning we can pass on those savings directly to the customer,” Barkle said. “Where we intend to compete is on providing a unique experience that improves discovery and satisfaction.”

MyDeal recently launched a “shop and earn” program that Barkle said is unique among Australian marketplaces. It allows customers to earn credits that they can then put towards later purchases every time they buy something on MyDeal. The amount of credits they earn depends on the seller they buy from, which is designed to encourage healthy competition among sellers to drive sales. Barkle said the site has seen a substantial increase in customer retention since launching the program three months ago.

Barkle also spoke obliquely about using technology to bring customers as close to touching and feeling the product as is possible online, something that other online retailers, including Temple & Webster, have flagged as being possible with augmented and virtual reality. But like its competitors, MyDeal mostly seems content to let demographics play to its advantage.

“We believe the penetration of online sales into furniture and homewares will substantially increase over the next five to 10 years, driven by millennial consumption,” Barkle said.

Comment Manually

You must be logged in to post a comment.

No comments