Toys ‘R’ Us shuts down e-commerce business

Toys ‘R’ Us has shut down its American e-commerce platform and is directing customers to its in-store fire sales, following its liquidation announcement several weeks ago.

The US-based toy giant announced last Friday that it has swiped up to 30 per cent off its stock in its circa 800 US locations as it looks to clear inventory ahead of closures.

The fire sales won’t extend to e-commerce though, with the business telling customers late last week that they would no longer be able to order from the Toys ‘R’ Us or Babies ‘R’ Us online stores.

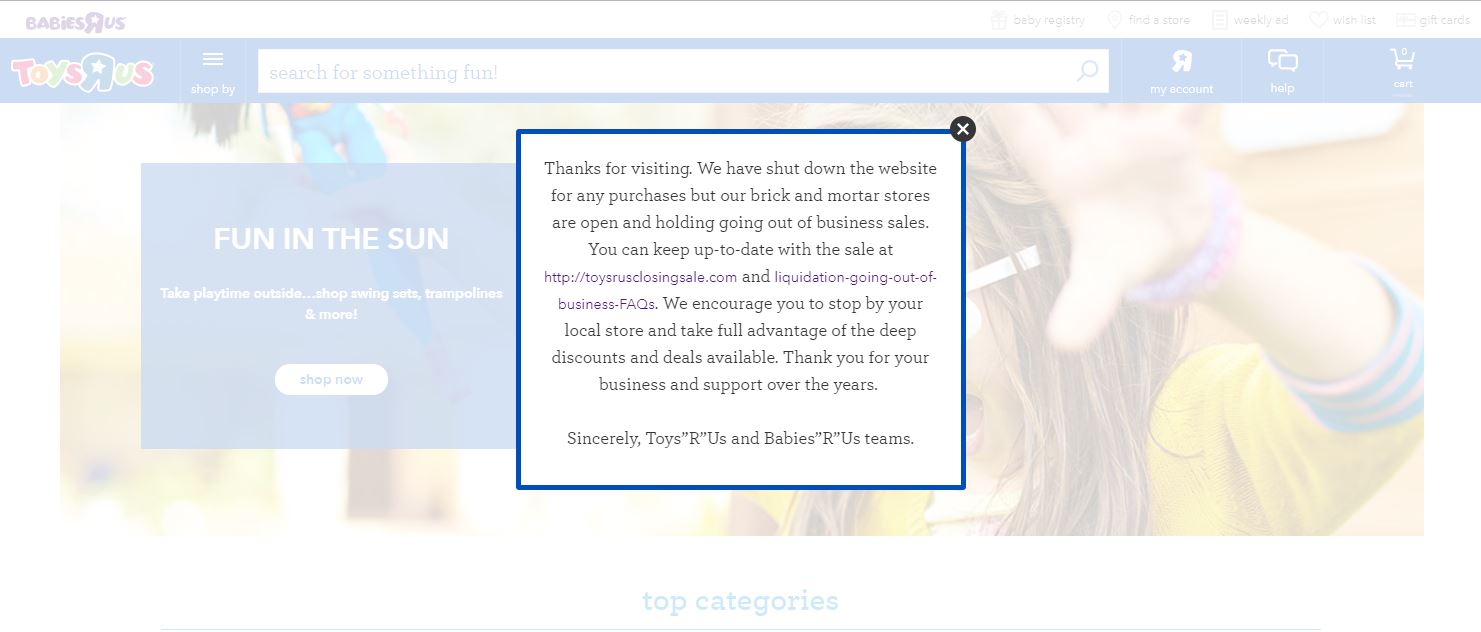

“Thanks for visiting. We have shut down the website for and purchases, but our brick and mortar stores are open and holding going out of business sales,” a pop-up statement on toysrus.com reads.

“We encourage you to stop by your local store and take full advantage of the deep discounts and deals available. Thank you for your business and support over the years.”

The business has launched a new website called toysrusclosingsale.com that includes information about the fire sale and store location details.

It comes as toy billionaire Isaac Larian, founder of Bratz dolls manufacturer MGA Entertainment, progresses a crowd funding campaign to make an offer to buy the business.

“We can’t sit back and just let it disappear. Everyone deserves to be a Toys”R”Us kid,” Larian said of his #savetoysrus endeavour.

“There is nothing quite like the joy and awe of a child walking through the aisles of a Toys”R”Us store, I want to preserve that innocent experience for future generations.”

But in 11 days only US$55,000 above the initial $200 million Larian put into the campaign has been raised, leaving the prospect that it will reach its $1 billion goal relatively slim.

Locally, the future of Toys ‘R’ Us is still unclear, although the Australian and Asian businesses have said they will continue trading, joint-venture partner for Toys ‘R’ Us Asia, Fung Retailing, has not commented on how it will fund a full acquisition of the business.

Comment Manually

You must be logged in to post a comment.

No comments