Redbubble boosted by global sales, eyes ASX listing

Customer growth, repeat purchases and offshore sales have helped online marketplace, Redbubble, lift its 1H2016 Gross Transaction Value (the cash of sales through the marketplace, including taxes and artist’s mark-up) to $80.6 million, an increase of 80 per cent on the comparable period.

During the half 1.25 million customers purchased art from the marketplace and an extra 107,000 artists signed up to sell their designs.

Redbubble intends to raise $50 million through an ASX IPO in June. The capital raised will enable them to implement their global growth strategy, which began with a launch of a German language website in March.

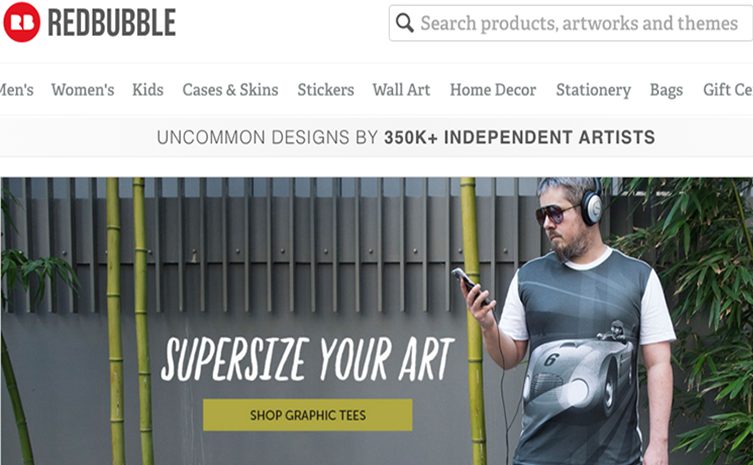

“Redbubble is fast becoming the largest global consumer internet company to have come out of Australia,” said CEO and co-founder, Martin Hosking said. “With 93 per cent of sales offshore, we have caught a global consumer trend towards more distinctive and personalised products.

“Growth during the half-year highlighted the marketplace dynamics at play at Redbubble,” said Hosking. “Redbubble’s growth continues to be largely organic – as more artists join, more customers have a reason to buy and with more customers, there is more reason for artists to sell through the marketplace. This contrasts how traditional retailers work which generally rely on paid acquisition to grow.”

Last week Redbubble announced it finalised a $12 million pre-IPO funding round led by Blackbird Ventures, undertaken to bring new institutions onto the Redbubble register.

“We are pleased to have chosen the ASX as our preferred market for listing, and are seeing support here for a truly global company. The capital raised will help us in implementing our growth strategy and pursue our global ambitions,” said Redbubble non-executive chairman, Richard Cawsey.

To position Redbubble for the next wave of growth and prepare them for their IPO listing, they have made a number of key hires, including former Silicon Valley based VP of Engineering at Indiegogo, Victor Kovalev as CTO, former Centro Properties Group CFO Chris Nunn as CFO and board regular, Grant Murdoch as non-executive director.

Comment Manually

You must be logged in to post a comment.

No comments