Cryptocurrency unlikely to take off in Australia: RBA

The Reserve Bank of Australia has stated that as long as the Australian dollar continues to provide a reliable, low-inflation store of value, cryptocurrency is unlikely to take off in any meaningful way in Australia.

The statement comes as social-media giant Facebook outlines its plans to launch its own cryptocurrency – Libra – in 2020.

“The terms ‘bitcoin’ and ‘cryptocurrency’ are widely known… however, neither Bitcoin nor the many thousands of cryptocurrencies that have followed have become widely used for payments,” an RBA report released on Thursday said.

“People are more likely to view cryptocurrencies as a speculative high-risk investment class than a payment system.

“We see little likelihood of a material take-up of cryptocurrencies for retail payments in Australia in the foreseeable future.”

Cryptocurrency, as a concept, aims to function as a peer-to-peer payment system. However, economic definitions of money refer to three key features: a means of payment, unit of account, and a store of value – something cryptocurrencies generally struggle with.

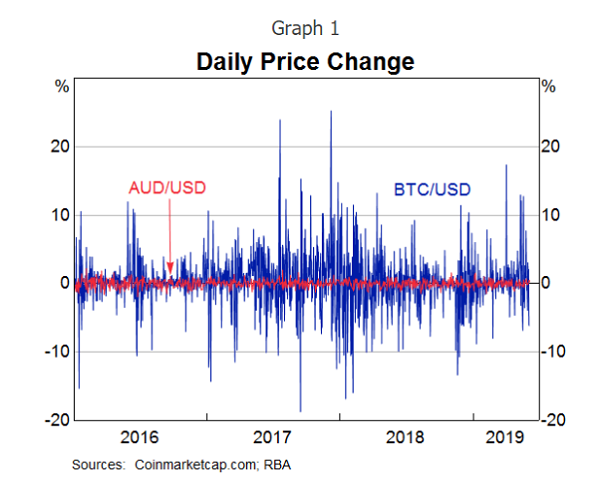

This is largely due to intense fluctuation in value for a single unit of a cryptocurrency, with a single bitcoin having fluctuate in value, between $25,000 and $5,000 per unit, in the last two years.

This is amplified by the fact that there are thousands of cryptocurrencies to choose from, creating a fragmented market. According to the report, the top 50 cryptocurrencies account for 95 per cent of market capitalisation, with the remaining 2000+ accounting for the 5 per cent left over.

CoinMarketCap, a crypto-asset information service, presents that only around half of these crypto-assets have existed for more than a year, and 40 per cent of those removed from the service in the past four years were also less than a year old.

According to the report, the short lifecycle of certain cryptocurrencies may also reflect the rapid pace of technological development in the space, with ‘coins’ potentially becoming discarded as they become ‘old–tech’.

This also limits cryptocurrencies ability to be measured as a “store of value”, with any coins purchased running the risk of being left behind as technology moves on.

“It remains the case that no cryptocurrencies currently function as money in Australia, or as widely used payment methods,” the report reads.

“Many continue to be a work in progress and they generally come at the cost of making the cryptocurrency more centralised, a feature that may not be attractive to crypto-libertarians and in any case makes them more similar to established payment systems.”

Comment Manually

You must be logged in to post a comment.

No comments