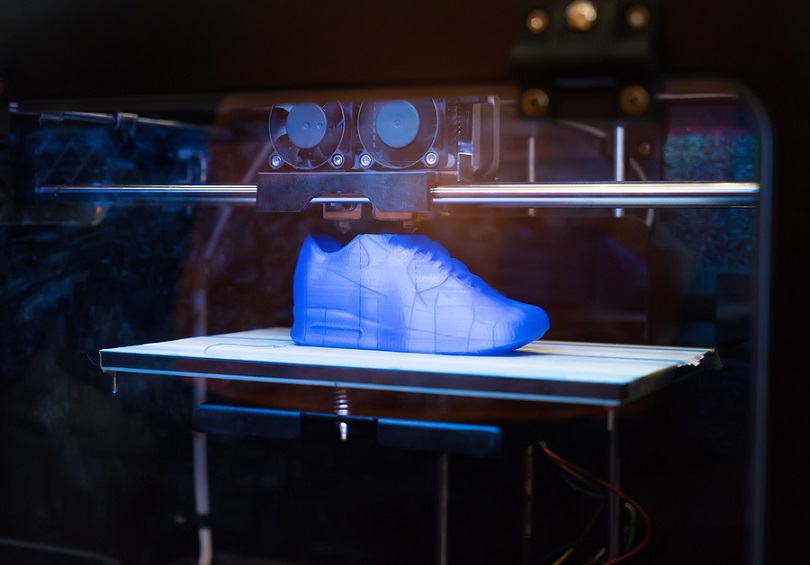

3D printed sports shoes are more about your wallet than your feet

The race is on to bring 3D printed footwear to market. Adidas, Nike and Under Armour are some of the big names that have been working on delivering bespoke shoes to their customers.

From the sounds of their marketing, you may be forgiven for believing that bespoke shoes are just a footstep away. But a closer look at what’s on offer shows that the value in 3D printing is more for marketing for the brands themselves than the consumer.

According to Nike’s chief operating office Eric Sprunk, customers will one day be able to 3D print their shoes at home – they simply have to buy and download the specifications they want from an online store. More realistically, this will take place in a retail shop. But, either way, made-to-order, perfectly fitting footwear remains a long way off.

In the interim there will still be factories. Adidas, for example, is building its “Speedfactory” in Ansbach, Germany, using 3D printing and robotics to cut down the delivery time of bespoke footwear to one week for online orders. Here Adidas makes its new Futurecraft 4D shoe, which promises that it can be moulded to an individual’s data.

But so far even this is largely only a promise. There are only very limited styles in the offing – and so far it’s still based on standard sizing. Elements of customisation are possible but only in terms of the level of cushioning in the sole.

Need for speed

It’s been a while since shoes were made to fit their owners. The mass market means that most people buy shoes based on standard sizes and styles. Sports shoes are largely made in China or Vietnam, shipped around the world and then stacked in retail shops waiting to be purchased.

From a business perspective, retailers must make their best guess at what will sell (and what won’t) and in what quantity – and buy stocks accordingly. Brands tend to place orders 12 to 18 months in advance with their manufacturers. Heavy advertising is needed to drum up demand for new styles and, despite this, many pairs will have to be shifted at a discount. So, for the retailers, the ability to make a customer’s shoe to order at speed is very appealing.

Many brands do allow customers to go online to order pairs with a limited amount of customisation. Take a look at your sports shoes. They are comprised of an outer sole, inner sole, the uppers – comprising of two or three pieces sown together and laces. Adidas (via mi-Adidas) and Nike (via NikeiD) already allow you to choose each of these components from a limited menu of colours, using a standard size and style.

The company (or its contract manufacturer) will then collect and assemble these pieces, stitch or glue them, and deliver your bespoke pair in four to five weeks – all for a premium price. Moreover, returns are not allowed, removing one of the big problems with online sales for manufacturers. Plus, the use of 3D printing and robotics to make shoes in-country mean they can deliver shoes even quicker.

Value for whom?

When you break down what consumers get with 3D printed sports shoes, they aren’t particularly good value compared to buying off the shelf. Even with Adidas’s Futurecraft 4D you are still selecting a standard style. With others you are still limited by standard sizes. Leather cannot be 3D printed, only fabric knitted by a machine, removing this element of customisation too.

That leaves the soles. Thanks to new technology from US-based company, Carbon, these can be mass produced relatively quickly using 3D printers. A video from Adidas of its Futurecraft 4D footwear shows the top part made of knitted fabric that is cut with robots, with the pieces then being assembled and stitched manually (in high labour-cost Germany).

Clearly a big part of the value comes in brands being able to offer high-tech shoes that will be incredibly exclusive when they are first brought to market. The sole is 3D printed but at present it is a long way from offering the level of customisation that you would associate with this technology. All in all, the consumer is not getting much value beyond making the choice in colour schemes that these companies already provide, but with reduced delivery time.

While the consumer will not get much value, the brands will. This is because 3D printing allows them to claim association with a “high-tech” sole and, along with this, “superior performance”. It gives brands the kind of halo that the chess-playing computer Deep Blue brought IBM – and Deep Blue too was largely used for marketing and was retired by the company as soon as it had beaten world champion Garry Kasparov once.

The brands can also get marketing value by learning the preferences of early adopting consumers. They can use this information to inform their own orders made in advance to their Asian manufacturers for the mass market end of the business, which produces hundreds of millions of pairs compared to the limited edition high-tech offering.

For now, at least, 3D printing in the sports shoe business is targeting consumers’ wallets rather than their feet.

rofessor of operations and supply chain management at City University of London

This story first appeared on The Conversation.

Comment Manually

You must be logged in to post a comment.

No comments