Six takeouts from CommBank’s latest retail report

The Commonwealth Bank this week released its first CommBank Retail Insights report based on survey results of more than 500 retailers around Australia and analysis of more than $3 billion in online spend made on CommBank credit cards.

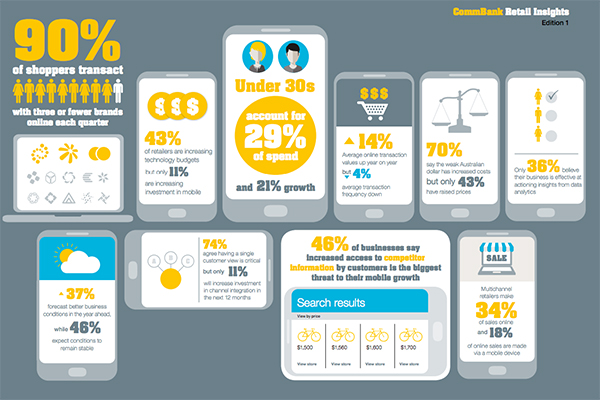

“The Australian mobile and online market remains relatively immature, skewed towards the under-30s, with ample scope for future growth,” said Jerry Macey, national business manager, retail business and private banking.

“That means there are still opportunities for retailers to benefit from a growing market, even if they have been relatively slow to establish a strong online presence.”

- Fewer shops, bigger baskets

While there are more people shopping online, the number of transactions has decreased and basket value is growing. CommBank spending data shows the average online transaction increased from $37 to $42 in the last lear, with a total average annual spend per shopper of $692, up from $627.

“Convenient returns are an important driver of online confidence. With two-thirds of retailers now offering delivery and collection options, it’s likely that consumers feel more comfortable buying bigger ticket items, knowing they have the option to return them if they’re not fully satisfied,” Macey said.

- Online shoppers are selective

Consumers are highly selective, preferring to shop with just two or three trusted online retailers. According to CommBank, 90 per cent of shoppers transact with three or fewer brands online each quarter.

- Domestic market focus

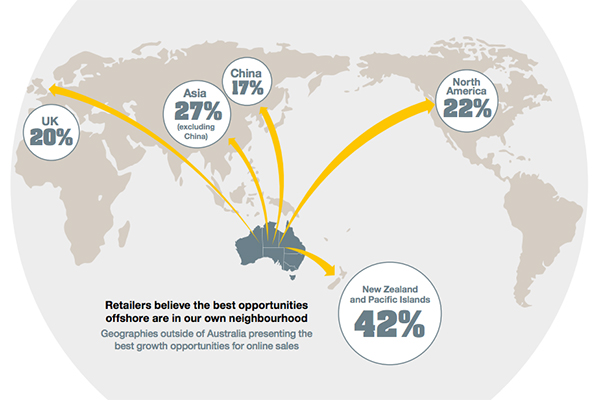

Australian online retailers remain focused on the domestic market, only 21 per cent generate sales offshore. Yet the survey shows retailers believe there is potential to reach out to a wider market, particularly in New Zealand and the Pacific region.

- Mobile continues to grow

According to CommBank, 18 per cent of online sales now happen on a mobile device and, one third of retailers expect to make more than half of their online sales via mobile in the next 12 months. Overall, 41 per cent of retailers say more consumers are using their mobiles to buy more often their devices.

With the ability to access information via mobile devices, customers can just as easily view competitors information and offers and, 46 per cent of retailers believe mobile devices will increase competition.

- Different approaches to investing in mobility

CommBank said pureplay retailers were leading the market in developing apps and utilising social, maximising reach across channels. While multichannel retailers are focused on improving accessibility and integration.

One third of retailers say they are optimising their sites for mobile use, only 11 per cent plan to invest in mobility over the next 12 months and just 1 per cent say mobility is their highest priority investment.

“Many retailers appear to be asking whether they really need an app, when they can simply sell through a mobile-optimised website. But when it comes to leveraging the additional benefits mobile offers, like rich location data and location-driven loyalty programs, apps would seem to come into their own,” Macey said.

- The struggle for a single customer view

Three out of four retailers agree that achieving a single customer view is critical. However, only 41 per cent of multichannel retailers have integrated their physical outlets with their other channels, while 19 per cent have not integrated any of their channels. CommBank said the overall view provided by the research suggests retailers are held back from further integration by lack of expertise and tight budgets.

Comment Manually

You must be logged in to post a comment.

No comments